House Budget Committee chairman and supposed GOP wunderkind Paul Ryan chose the wrong the week to attack President Obama for "sowing social unrest and class resentment." After all, just one day earlier the CBO confirmed that income inequality in the U.S. is at highest level in 80 years, a yawning gap certain to be enlarged by the latest crop of proposed Republican tax cut windfalls for the wealthy. Worse still, 24 hours after Ryan accused Obama putting the nation on path to "painful austerity, the kind you see in Europe," new GDP figures showed the U.S. economy grew at a healthier 2.5 percent last quarter. Meanwhile in the UK, where the Conservatives' draconian austerity program is now well underway, the economy has ground to a complete halt.

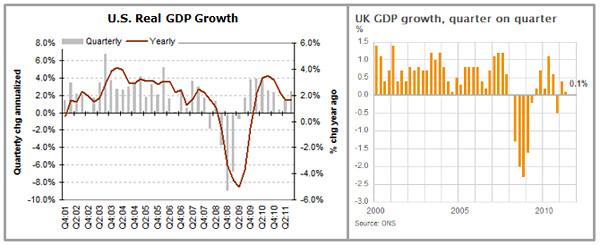

Writing in the New York Times, Catherine Rampell summed up the new U.S. GDP data from the Bureau of Economic Analysis. "The American economy, "she wrote, "has finally reached the size it was before the recession began four years ago." But as Martin Sullivan explained in words and pictures (above):

Republicans constantly remind us that the Obama stimulus--the American Recovery and Reinvestment Act of 2009--did not work. They voted against it. In the United Kingdom the government is led by Conservative Prime Minister David Cameron. His government did not adopt stimulus. Instead it boldly enacted an economic program that cut spending and raised taxes. The chart below shows the results and compares it to the U.S. experience. After three and a half years, U.S. GDP is just about returning to the pre-recession peak. That's awful. But it's far better than the U.K. where GDP is still five percent ($750 billion in US terms) below its pre-recession peak.

If anything, Sullivan understates the divergent paths and performance of Team Obama in Washington and David Cameron's Tory "austerians" in London. As the data show, the 2008 economic calamity in the U.S. was more severe. As The Economist and Ezra Klein of the Washington Post documented, only months after the February 2009 passage of the stimulus did the White House and the American people learn than the U.S. economy actually contracted by a staggering 8.9 percent in the last quarter of 2008. Reviewing CBO data, the Center on Budget and Policy Priorities found that without the American Recovery and Reinvestment Act, U.S. GDP could have been up to 2.5 percent lower. By the third quarter of 2011, CBO estimated that ARRA saved up to 2.5 million jobs and reduced the unemployment rate by 1.3 percent. As former McCain economic adviser Mark Zandi put it last year, federal intervention prevented "Depression 2.0."

To be sure, trillions in lost economic growth, persistently high unemployment and consumer spending stuck at 2006 levels are nothing to write home about. But British Prime Minister David Cameron would take U.S. economic performance in a heartbeat.

To be sure, the economic pictures in the UK and the U.S. are far from identical. While the depth of the recession was worse here, as a percentage of GDP London has much higher taxes, spending and debt. Compared to the relatively paltry $39 billion in spending cuts secured by this spring's budget agreement in Washington, Prime Minister David Cameron's austerity budget announced last October seeks to close the budget gap within five years by slashing spending, raising taxes and sacking 490,000 government workers. (Left unmentioned by American conservatives is the fact that the British plan counts on value-added and income tax increases - including a top rate of 50 percent for the wealthiest in the UK - to reduce its national debt.) While the forecasts for the U.S. economy remain mixed, across the pond the picture is much bleaker still.

Sadly for the British, as Paul Krugman sighed in April, "contractionary fiscal policy is, well, contractionary."

Now well into Cameron's painful austerity program British GDP grew by only 0.2 percent in the second quarter. After a half-point decline in Q4 and a meager 0.5 percent gain in the first three months of the year, the UK economy is flat-lining. As the Wall Street Journal summed it up:

The U.K.'s Office for National Statistics said gross domestic product grew 0.2% between April and June after expanding by 0.5% in the first quarter. The year-on-year growth rate slowed to 0.7% from 1.6% between January and March as the economy failed to get moving in the quarter.

While the Q2 performance was held back by one-time factors including the Japanese earthquake and the royal wedding, the picture for the next three months looks like bleak as well. As the Journal also lamented:

Barely a day after the U.K.'s dismal growth figures for the second quarter and already the first signs of what lies ahead are emerging. In summary: It doesn't look good.

Those grim forebodings followed the spring of England's discontent. In March, hundreds of thousands of demonstrators took to the streets of London to protest deep spending cuts. In April, the BBC reported "UK economy faces 'worrying' times" as the OECD lowered its UK growth forecast for the rest for year. Meanwhile, the Guardian warned David Cameron's Tory government:

Some of the UK's most prominent business leaders, including individuals who gave their personal stamp of approval to the chancellor's aggressive spending cuts, have said they have growing concerns about the state of the economy, warning of weak growth and rising inflation ahead.

As the New York Times explained earlier this year, policymakers on this side of the Atlantic will be looking for the lessons learned at 10 Downing Street:

In the United States, the debate over how to cut the long-term budget deficit is just getting under way.

But in Britain, one year into its own controversial austerity program to plug a gaping fiscal hole, the future is now. And for the moment, the early returns are less than promising.

Retail sales plunged 3.5 percent in March, the sharpest monthly downturn in Britain in 15 years. And a new report by the Center for Economic and Business Research, an independent research group based here, forecasts that real household income will fall by 2 percent this year. That would make Britain's income squeeze the worst for two consecutive years since the 1930s.

Sadly, Paul Ryan and the Republicans in Washington seem to be learning all the wrong lessons from the British experience.

This spring, 235 House Republicans and 40 GOP Senators voted for the Ryan budget which sharply reduces spending, slashes Medicaid and privatizes Medicare all while delivering another massive tax cuts windfall for the wealthy. But as Moody's Economics' Zandi concluded, supposed job creator Paul Ryan is actually a job killer:

Real GDP in 2012 under the Ryan plan is $123 billion lower than in the president's plan and there are 900,000 fewer payroll jobs in the U.S. By 2014, real GDP is almost $200 billion lower and there are 1.7 million fewer jobs under the Ryan approach than is the case under the president's.

And what Ari Berman deemed the "Austerity Class" would hardly stop there. In their answer to President Obama's American Jobs Act, GOP Senators Rand Paul and John McCain two weeks ago unveiled their own "Jobs through Growth Act." Once again, as the Washington Post's Greg Sargent learned in an interview with Moody's Gus Faucher, the GOP's austerians would stop the recovery dead in its tracks:

Moody's recently estimated that Obama's jobs plan, if passed, would add two percentage points to economic growth next year, add 1.9 million jobs, and cut unemployment by a full percentage point. By contrast, the Senate GOP plan isn't designed to help the economy in the short term, Faucher said.

"Should we look at regulations and make sure they make sense from a cost benefit standpoint? Certainly. Should we reduce the budget deficit over the long run? Certainly," Faucher said. "But in the short term, demand is weak, businesses aren't hiring, and consumers aren't spending. That's the cause of the current weakness -- and Republican Senate proposals aren't going to address that in the short term."

"In fact, they could be harmful in the short run, if the focus is on cutting spending," Faucher continued. "They don't say explicitly when they would cut spending, but the Republican focus is on cutting spending sooner and later."

So much for John McCain's promise that Republicans would deliver "billions and billions of jobs."

And so much for Paul Ryan's Ayn Randian language of "takers versus makers" and his jaw-dropping projection at the Heritage Foundation this week.

"Let's review for a moment the path we are on, where we stand right now. It pains me to say this, but it's become clear that the president has committed us to the current path: higher taxes, more dependency, more bureaucratic control, inaction on the drivers of our debt -- just not even dealing with it -- and painful austerity, the kind you see in Europe."

Unfortunately for Paul Ryan, Americans have already seen his dystopian future in the painful austerity in Europe. As it turns out, Ryan's American dream is England's nightmare present.

(This piece also appears at Perrspectives .)